Keychain Selected as Technology Vendor for Digital Identity Pilot Supported by Japan’s Financial Services Agency

January 15 2025

Tokyo

Keychain GK, a leading digital trust technology provider, was seledted as a technology vendor for a digital identity pilot sponsored by Japan's Financial Services Agency and a consortium led by Mitsubishi UFJ Trust and Banking Corporation.

Tokyo, Japan – Keychain GK (Head Office: Minato-ku, Tokyo; CEO: Jonathan Hope), a leading provider of decentralized identity and data security solutions, announced today that it has been selected as a technology vendor for a government-backed digital identity pilot. The pilot is supported by Japan’s Financial Services Agency (FSA) under its FinTech Proof-of-Concept Hub, and explores the use of Verifiable Credentials (VCs) to streamline customer identity verification in compliance with Japan’s Act on Prevention of Transfer of Criminal Proceeds.

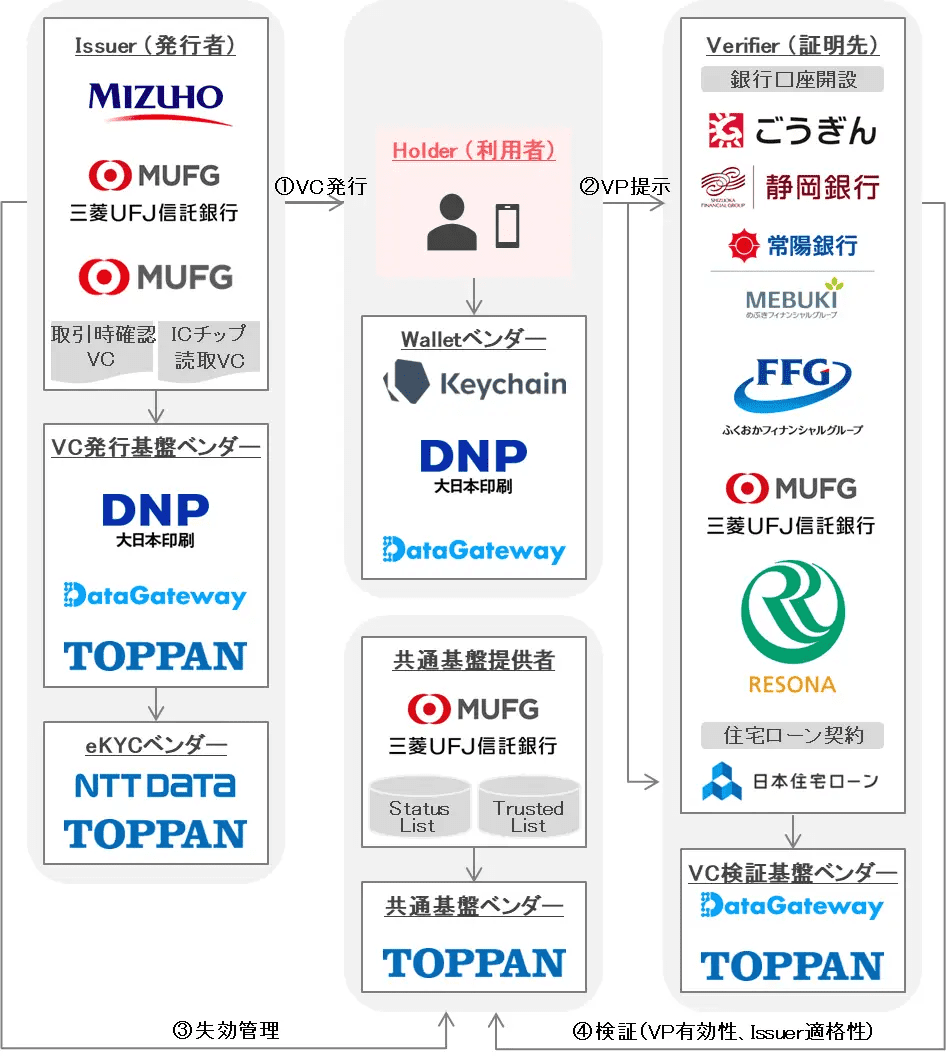

Keychain will contribute to the project by developing the mobile wallet application used by customers to store and present their verifiable credentials. This initiative is part of a broader technical collaboration under the Decentralized Identifier / Verifiable Credential Co-Creation Consortium (DVCC), led by Mitsubishi UFJ Trust and Banking Corporation (President: Iwao Nagashima). As of November 2024, DVCC includes 49 participating organizations.

About the Pilot Project

Objective

The pilot will evaluate a new identity verification model that allows individuals to reuse verified credentials—originally issued by one financial institution—for onboarding or transactions at other institutions. The goal is to reduce repetitive identity checks while maintaining a high level of regulatory compliance and security.

This model addresses inefficiencies in the current know-your-customer (KYC) process, where consumers must repeatedly submit identity documents (e.g., national ID, driver’s license) to each financial provider. By enabling cross-institutional reuse of identity verification results via VCs, the project seeks to combine convenience with strong compliance standards.

Interoperability Testing

The pilot will also evaluate the interoperability of VCs across different platforms, with participants testing the exchange of credentials between systems developed by multiple vendors.

Project Timeline

- Start: December 2024

- End: March 2025

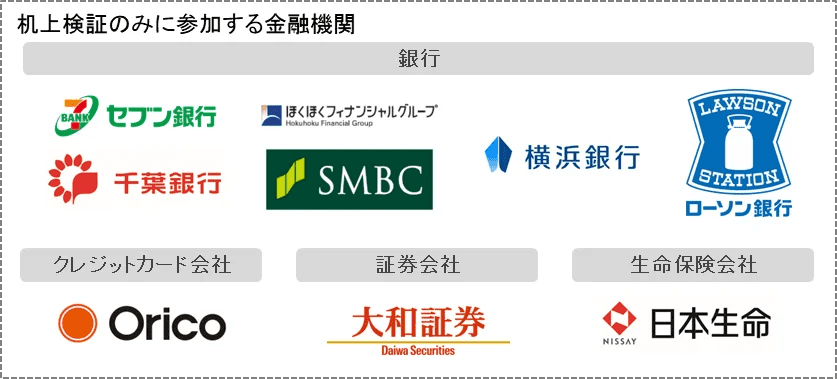

- Participants: Leading Japanese financial institutions and identity solution vendors, with testing conducted through DVCC’s “KYC Working Group.”

Regulatory Context

Under Japan’s anti-money laundering laws, financial institutions must verify a customer’s identity at the time of account opening or high-value transactions. This includes:

- Presentation of government-issued ID

- Verification of name, address, and date of birth

- Collection of purpose of transaction, occupation, and other relevant information

This initiative aligns with international AML/CFT (Anti-Money Laundering / Countering the Financing of Terrorism) standards, while introducing digital innovation to reduce friction and improve security.

About Keychain

Keychain develops secure, decentralized identity infrastructure for Web3, enterprise, and financial applications. With expertise in blockchain, cryptographic key management, and verifiable credentials, Keychain enables the next generation of digital trust and data sovereignty.